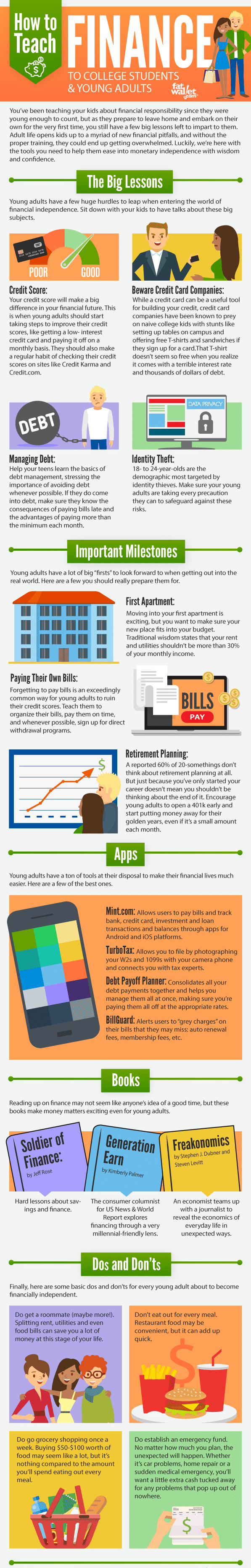

How to Teach Finance to College Students & Young Adults

By CouponlabYou’ve been teaching your kids about financial responsibility since they were young enough to count, but as they prepare to leave home and embark on their own for the very first time, you still have a few big lessons left to impart to them. Adult life opens people up to a myriad of new financial pitfalls, and without the proper training, they could end up becoming overwhelmed. However, you can still be there to help them ease into monetary independence with wisdom and confidence.

Article continues below infographic

As kids enter adulthood, the real world will be knocking at their doors, sometimes pretty aggressively. Major financial milestones that always seemed years away are now demanding to be dealt with. Credit scores may have seemed like a foreign concept when they were 9 or 10, but now it’s something they really need to worry about. Your child’s credit score will determine so much of their financial future, and this is the time when young adults should start taking steps to improve their scores, like getting a low-interest credit card and paying it off on a monthly basis. They should also make a regular habit of checking their credit scores on sites like Credit Karma and Credit.com.

Speaking of credit cards, this is also when your kids will be getting their first ones, and while charge cards are important, they can also carry a great deal of risk. Credit card companies have been known to prey on naïve college kids with stunts like setting up tables on campus and offering free T-shirts and sandwiches if they sign up for a card.That T-shirt doesn’t seem so free when you realize it comes with a terrible interest rate and the potential for thousands of dollars of debt. Make sure you’re helping your children pick the right card for their situations, one that won’t drown them in debt they’ll be paying off for the next 20 years. Also, be sure to teach them how to check their credit card and bank statements. Identity theft is a major risk for people age 18 to 24, so make sure your kids know how to look out for it by checking their statements for any irregularities or surprise purchases.

Moving out on their own will also come with its fair share of new financial responsibilities. A first apartment is an exciting time in everybody’s life, but it shouldn’t be entered into without some major forethought. Make sure their new place fits into their budget. Traditional wisdom states that your rent and utilities shouldn’t be more than 30% of your monthly income. Also, remind them of the importance of paying their bills. Forgetting to pay utility bills is an exceedingly common way for young adults to ruin their credit scores. Teach them to organize their bills, pay them on time and, whenever possible, sign up for direct withdrawal programs.

Luckily, young adults have tons of helpful apps at their disposal to supplement your parental wisdom and make their financial lives much easier. Some of the best ones include Mint.com, the TurboTax Mobile App and Billguard. Mint.com allows users to pay bills and track bank, credit card, investment and loan transactions and balances through apps for Android and iOS platforms. The TurboTax mobile app allows you to file by photographing your W2s and 1099s with your camera phone and connects you with tax experts. And BillGuard protects you from identity theft by alerting users to “grey charges” on their bills that they may miss, such as auto renewal fees, membership fees, etc. There are also a lot of great books that are equal parts informative and entertaining. “Generation Earn” by US News & World Report’s Kimberley Palmer explores financing through a very millennial-friendly lens, and “Freakonomics” by Stephen J. Dubner and Steven Levitt features an economist who teamed up with a journalist to reveal the economics of everyday life in unexpected ways.

At this point, you’re just about ready to gently nudge your kids out of the nest, but there are still a few simple dos and don’ts you can give them that will really enhance their financial futures. Simple things like going grocery shopping instead of eating out for every meal will save them a lot of money in the long run. Establishing an emergency fund is also an extremely useful tip that newly independent adults might not think of. No matter how much you plan, the unexpected will happen. Whether it’s car problems, home repairs or a sudden medical emergency, you’ll want a little extra cash tucked away for any problems that pop up out of nowhere.

Finally, just because your kids are starting their adult lives doesn’t mean they shouldn’t be thinking about the end of them. This is when retirement planning should start. A reported 60% of 20-somethings don’t think about retirement planning at all. Encourage your kids to open a 401k early and start putting money away for their golden years, even if it’s a small amount each month.

No one can say for certain what your child’s financial future will hold. The world is unpredictable; there will be unexpected surprises at every turn, and you can’t be expected to protect your kids from all of them. But with the proper education, you can be sure they will have the knowledge to handle these surprises calmly and responsibly. What more could a parent hope for?

Sources:

http://www.daveramsey.com/blog/the-truth-about-teens-and-credit-cards/

https://www.nsbvt.com/assets/PDFs/idtheft.pdf

http://usatoday30.usatoday.com/money/perfi/college/2008-03-30-credit-cards-college_N.htm