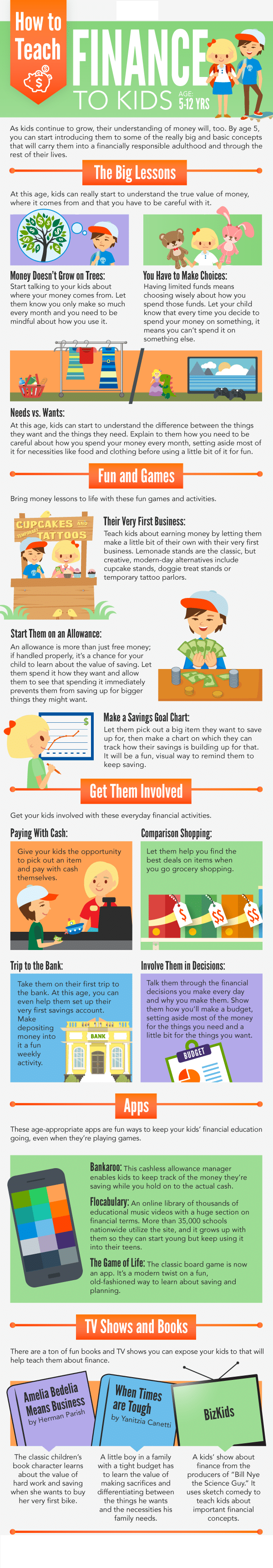

How to Teach Finance to Kids Ages 5-12

July 2025 by couponlab

As your children grow, so does their understanding of money. Even though most financial habits are ingrained in us by the time we turn 7, there are still plenty of lessons — good and bad — that you can impart on your children after that. Those lessons can determine the way they’ll handle their financial responsibilities for the rest of their lives.

The big financial concept that kids should start trying to wrap their heads around at this age is “needs vs. wants.” By this point, they should have a fair understanding of the value of money and that you need to save it in order to buy things. Now it’s time to teach them that some things, like food, shelter and clothing, take precedence over the more frivolous purchases. It’s a crucial step towards raising a child who will one day know how to properly budget independently instead of a child who grows up to call you at the end of every month asking for help with rent.

Although this can be a tougher concept for kids to grasp because they are still at an age when you will be providing for all of their needs, you can still involve them in the “wants vs. needs” decisions you have to make for the entire family. Explain to them how you have to sacrifice some of the fun and frivolous items they may want in order to pay for groceries, the electricity bill and more. This is a first step towards teaching them how to budget their finances. As they get older, you won’t just have to explain these decisions to them; you can actually encourage them to make them themselves. When you go grocery shopping with them, have them comparison shop. Let them find the most cost-effective brand of soda or cereal or whatever else they love. Give them a little bit of cash and a list of things they need to get for the family. Figuring out how to stretch their cash so they get all the items they need will be like building a little budget of their own.

You should also start giving them a regular influx of cash to manage all on their own. An allowance is more than just free money; if handled properly, it’s a chance for your child to learn about the value of saving and budgeting. Acquiring cash can also be fun for them. Let them set up their first business on your front lawn. Lemonade stands are classic, but creative modern-day alternatives include cupcake stands, doggie treat stands and temporary tattoo parlors. Go with whatever gets your kids excited about earning.

Books and television shows are all great tools to keep kids excited about learning, and at this age, there’s a ton of awesome entertainment that your kids will genuinely enjoy sitting through while still learning about finance. Classic children’s book characters have stories dedicated entirely to lessons about money, like “Amelia Bedelia Means Business” in which the absent-minded maid learns about the value of hard work and saving when she wants to buy her very first bike. There are also shows like “BizKids” on PBS that use sketch comedy to teach kids about important financial concepts, and coming from the producers of “Bill Nye the Science Guy,” it’s the kind of program that nostalgic adults will actually enjoy watching with their kids.

Seeing as your child probably spends a good deal of time on a smartphone, too, you might as well make some of that time informative. Apps like Flocabulary feature an online library of thousands of educational music videos with a huge section on financial terms. More than 35,000 schools nationwide utilize the site, and it grows up with them so they can start young but keep using it into their teens. There are also new twists on old games, like the Life App, which lets you play the classic life-planning board game on any tablet.

Most importantly, let them feel pride in their accomplishments.This is the perfect time to take them on their first trip to the bank. You can even help them set up their very first savings account. Make depositing money into it a fun weekly activity. Kids should view earning and saving as worthwhile goals of their own, not just stops on the way to something they want. They should feel proud every time they see their bank account grow a little bit more.

You should feel proud of them, too! As you watch your little ones’ sense of financial responsibility grow, you’re also watching them move towards a future of potential and promise. It’s one where they’ll have the skills to support themselves and stop relying on you.

Table of Contents