SURVEY: Super Bowl Drives Most TV Sales

July 2025 by couponlab

Table of Contents

“1 in every 10 Americans will buy a TV during Super Bowl Sales**.”

Announces 2023 TV Buying Survey:

The new survey (*TNS Global) reveals some exciting consumer buying trends for TVs, primarily related to the upcoming Super Bowl. With TV purchases increasing each January (1M in 2015 to >7M in 2022), the survey verifies the growth, claiming it’s now the #1 time of year people say they will buy a TV.

Of those surveyed online, 30% said they would purchase a new TV this year (35% males, 25% females, and 38% under age 30). Almost one-third of those will buy a TV during Super Bowl sales. The survey also reveals that their purchasing decisions are influenced by price, and the majority will spend less than $500.

Below are the full survey results for those that said they would purchase a new TV this year:

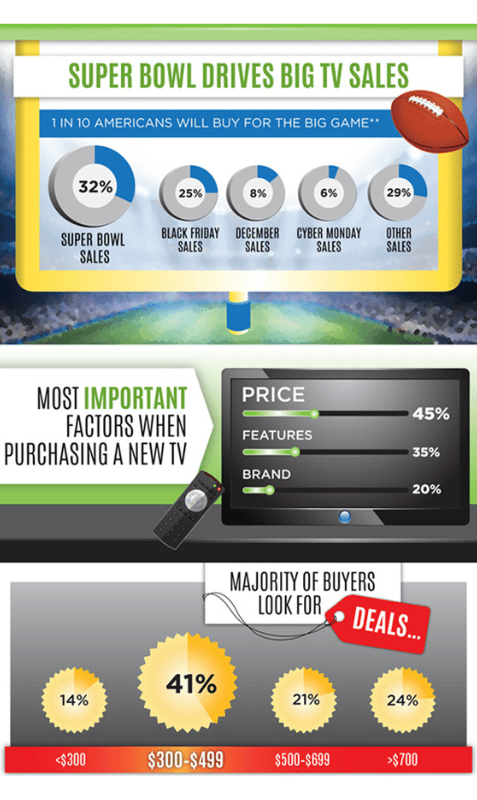

Super Bowl Drives Big TV Sales!

Q: During which sales event are you most likely to make a new TV purchase?

- 32% said Super Bowl Sales

- 25% said Black Friday Sales

- 8% said December/Holiday Sales

- 6% said Cyber Monday

- 28% said a variety of Other Seasonal Sales

Of Note: Almost half of Boomers will buy a TV during Super Bowl Sales (46%), and the other half (47%) during Black Friday. While only 6% will buy a TV on Cyber Monday, that number more than doubles to 14% for those under age 30.

The Price Is Right.

Q: Which category is most important when purchasing a new TV?

- 45% said the Price

- 35% said Features

- 20% said Brand

Of Note: Seniors (age 60+) say Brand (38%) beats Price (29%). More than half of those with children (54%) say the price is the significant factor.

Let’s Make a Deal.

Q: How much do you plan to spend on a new TV?

- 14% said Less than $300

- 41% said $300-$499

- 21% said $500-$699

- 24% said $700 or more

Of Note: While 41% will spend between $300 – 500, that number increases to 52% for those with an annual income under $30k. 1 in 4 will spend more than $700, 40% with a yearly income over $75k, and 9% with an annual income under $30k.

9 in 10 want prominent brand names.

Q: Which TV brand do you plan to purchase?

- 33% said Samsung

- 18% said, Sony

- 16% said LG

- 14% said Vizio

- 6% said Hisense

- 3% said TCL

- 4% said Budget Brands

- 6% said Other

Of Note: LG was most popular with Midwest TV Buyers (34%) and Sony’s most popular Brand for lower-income shoppers (25%).

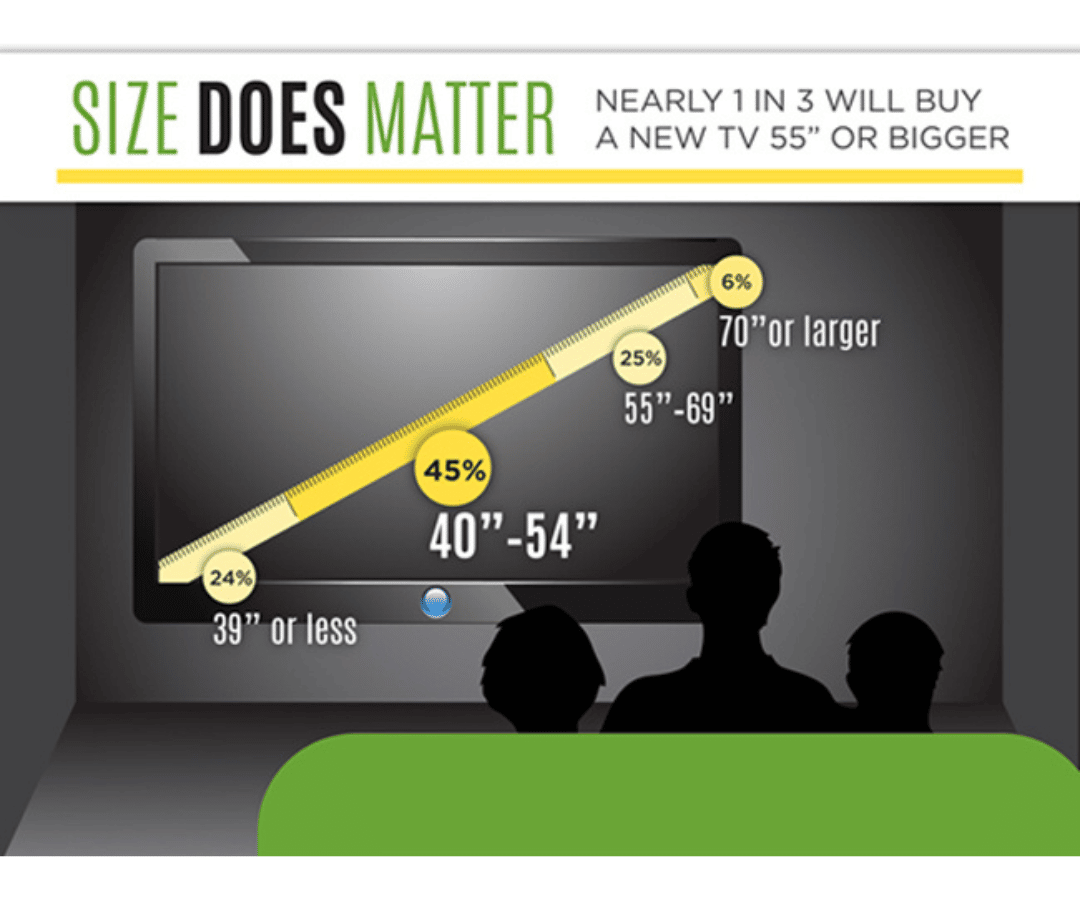

Size does matter!

Q: What size new TV will you purchase?

- 24% said 39” or less

- 45% said 40” – 54”

- 25% said 55” – 69”

- 6% said 70” or bigger

Of Note: Nearly 1 in 3 (31%) will buy a new TV 55” or bigger. While only 6% will purchase a new TV 70” or, more significantly, 15% of those on the West Coast want a giant screen.

86% want some clarity.

Q: Which feature is most important when purchasing a new TV?

- 14% said 1080p HDTV

- 46% said Full HD (high-definition)

- 34% said 4K UHD (ultra-high-definition)

- 6% said 8K

Of Note: More than one-third (35%) want a smart TV, and 45% are under age 50 or on the West Coast. Only 6% want a pricey new 8K TVs technology, but surprisingly 10% of those with an annual income under $30k want 4k.

Mobile Commerce gets in the game.

Q: Which way are you most likely to make a new TV purchase?

- 76% said In-store

- 15% said Laptops

- 4% said Smartphones

- 3% said Tablets

- 2% said Other

Of Note: 7% said they would buy a TV via their mobile device-expect that number to grow by the end of the year.